capital gains tax canada 2020

Schedule 3 is used by individuals to calculate capital gains or losses. How Much Capital Gains Is Tax Free In Canada.

The Tax Free Savings Account Tfsa Is One Of The Best Investment Vehicles Available To Canadians But Most Peop Tax Free Savings Savings Account Savings Chart

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have.

. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of. The inclusion rate is 50 so you add half of that gain 558308 to your total income for the. Whats new for 2020.

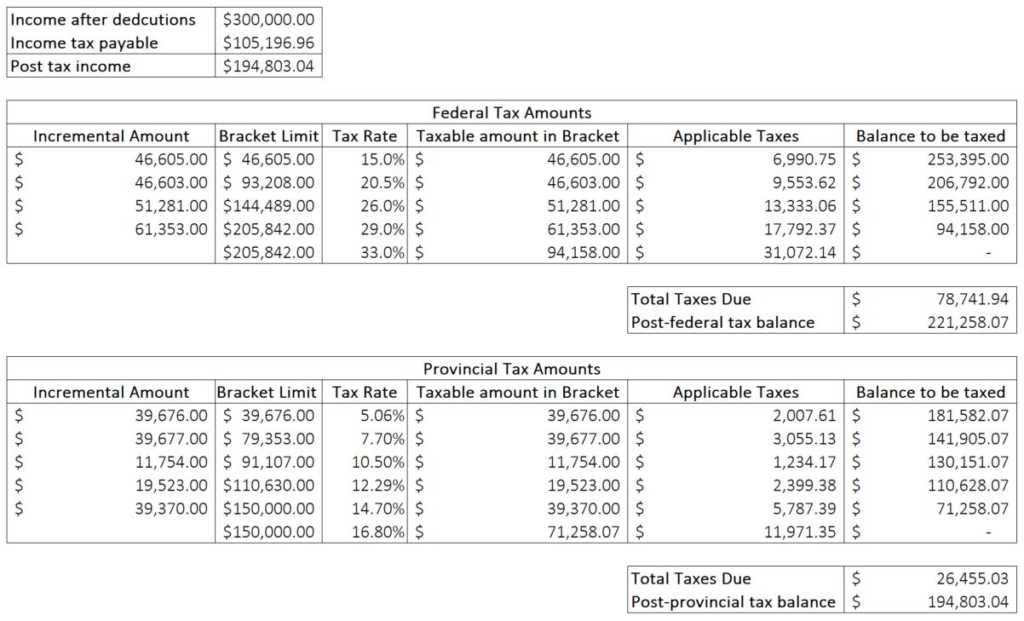

Capital Gains Tax Rates in 2020. 1316 on the portion of your taxable income that is more than. Instead capital gains are taxed at your personal income tax rate.

1 The personal amount is increased federally and for Yukon. 883384 in 2020 and 892218 in 2021 and 913630 this year. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

However as only half of the realized capital gains is taxable the deduction limit is in fact 456815. For best results download and open this form in Adobe ReaderSee General information for details. By Dan Caplinger - Updated Jan 2 2020 at 1004AM.

While all Canada Revenue Agency web content is accessible we also provide our forms and. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains. There are several ways to legally reduce and in some cases avoid paying taxes on capital gains.

1216 on the portion of your taxable income that is more than 150000 but not more than 220000 plus. Only 50 of your capital. How to reduce or avoid capital gains tax in Canada.

For more information see What is the capital gains deduction limit. Iain Butler and his team at Motley Fool Canadas Stock Advisor have released a special free report. An QSBCS disposition in 2020 will result in gains of 441692 per LCGE of 883384 or a deduction of 22 percent of the LCGE.

From 12719 to 14398 for taxpayers with net income line 23600 of. Lifetime capital gains exemption limit For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit. The sale price minus your ACB is the capital gain that youll need to pay tax on.

The capital gains tax rate in Ontario for the highest income bracket is 2676. Your sale price 3950- your ACB 13002650. That way they can pay as little capital gains tax as possible for 2020.

Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of. Generally capital gains are taxed on half of the gain. The taxes in Canada are calculated based on two critical variables.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. There is no special capital gains tax in Canada. T4037 Capital Gains 2021.

You deduct your exemption of 883384 to get a 1116616 taxable capital gain. Since its more than your ACB you have a capital gain. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Previous-year versions are also available. July 24 2020 at 119 pm.

How Much Tax Will I Pay If I Flip A House New Silver

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Top Canadian Etf Picks 2020 Dividend Investing Finance Investing Investing

Pin On Best Of Canadian Budget Binder

Capital Gains Tax What Is It When Do You Pay It

Income Tax Due Dates Income Tax Income Tax Due Date Income

Tangerine Tax Free Savings Account Tfsa Review 2020 Money Dot Calm Tax Free Savings Savings Account Saving Money Budget

Canada S Federal Personal Income Tax Brackets And Tax Rates 2022 Turbotax Canada Tips

Makmn Co In Indirect Tax Financial Management Income Tax

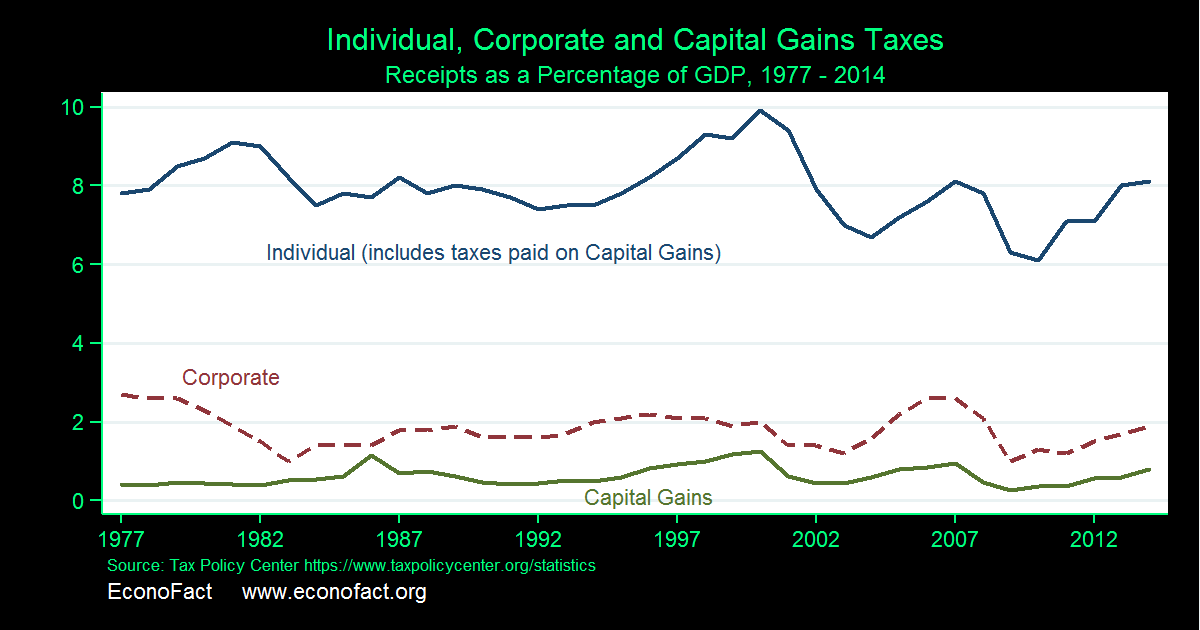

The Capital Gains Tax And Inflation Econofact

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How High Are Capital Gains Taxes In Your State Tax Foundation

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Your Guide To Tfsa Contribution Room Withdrawals And Investment Gains Investing Investment Loss Canadian Money

Taxation Of Investment Income Within A Corporation Manulife Investment Management